ISLAMABAD: Pakistan’s coalition government presented the finance bill in the National Assembly on Wednesday, with a significant increase in income taxes for the salaried class to meet IMF conditions for a new loan programme.

Under the new federal budget for 2024-25, the salaried class will now be subject to up to 35 percent income tax, in addition to the existing 18 percent sales taxes and property taxes.

The revised income tax slabs for the salaried class indicate that a higher tax rate will apply from July 1, 2024, for individuals with annual taxable income exceeding Rs. 600,000.

For those with taxable income between Rs. 600,000 and Rs. 1,200,000, the tax rate will be Rs. 2,500 or 5 percent, double the existing tax of Rs. 1,250. Individuals earning up to Rs. 600,000 will remain tax-free.

In the income bracket of Rs. 1,200,000 to Rs. 2,200,000, the tax rate has been increased to Rs. 30,000 plus 15 percent of the amount exceeding Rs. 1,200,000.

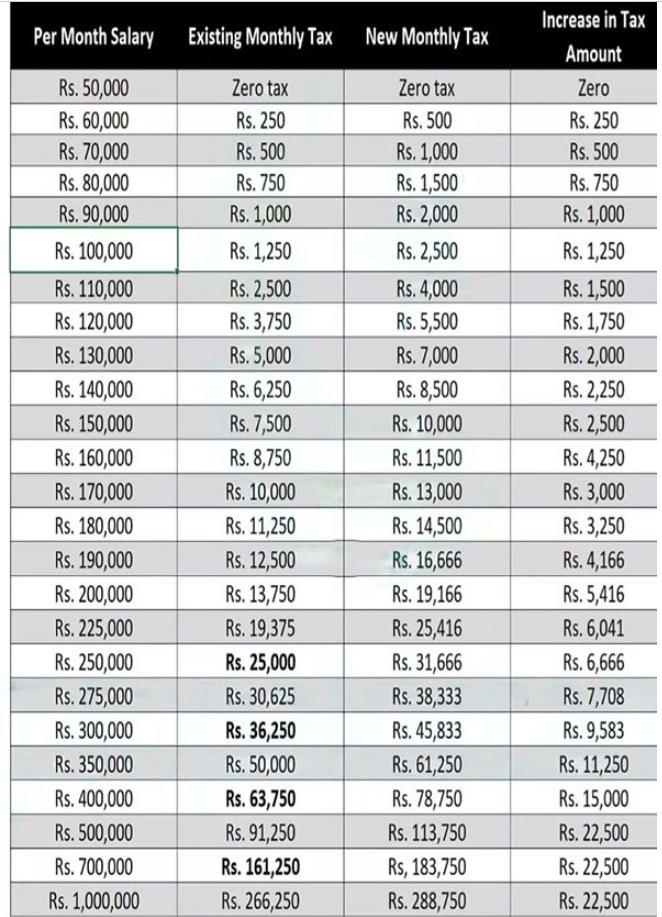

The following table provides a detailed breakdown of the impact of the new income tax rates on the salaried class from July 1, 2024: