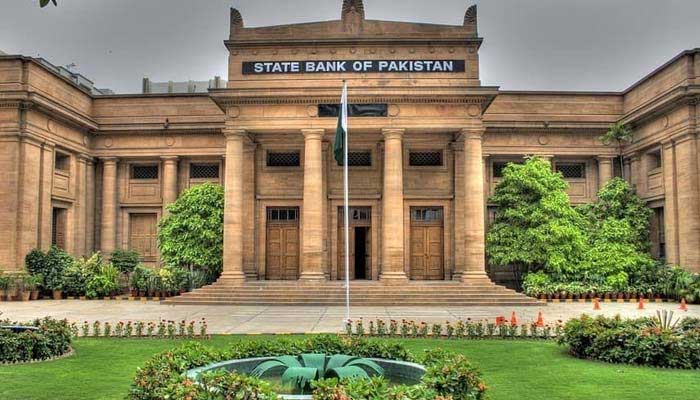

The State Bank of Pakistan’s (SBP) Monetary Policy Committee (MPC) has reduced the key policy rate by 200 basis points to 17.5%, marking the third consecutive rate cut. The new rate is effective from September 13, 2024.

The decision follows a significant drop in both headline and core inflation over the last two months, primarily due to delayed energy price hikes and favorable global oil and food prices. Despite these improvements, the MPC highlighted the uncertainty surrounding these factors, which warranted a cautious approach.

Key factors influencing the decision include declining global oil prices, improved business confidence, and a noticeable drop in secondary market yields of government securities. However, the committee also noted challenges such as weak official FX inflows, continued debt repayments, and lower-than-target tax collection by the FBR.

The MPC believes the current policy rate will help achieve the medium-term inflation target of 5-7%, supporting macroeconomic stability and sustainable growth.